Table of Contents

11 minute read

Over the past year, robo advisors have started to gain traction in the Malaysian investing scene. Still, many have never heard of it, or know of how to incorporate them into their portfolios.

Singaporean based StashAway was the first robo advisor to gain Securities Commission approval in Malaysia. Not long after, MyTheo and Wahed Invest joined the fray to provide some welcomed competition in the scene.

I’ve been investing in robo advisors for just over a year now, and I see 3 clear reasons on why they’re perfect for the young investor (not saying they’re not for the others!).

Let’s get started!

1) Robo advisors remove emotions from investing

Robo advisors are a class of financial products that aim to manage your portfolio with minimal human intervention. They’re meant to remove from investing an unavoidable trait we human beings have, emotions. In the investing world, emotion destroys.

Hype investing

An investment bubble forms when a financial product gets over hyped by the general public. The term bubble is used because the price tends to rise and rise till it reaches an unsustainable point and just… pops.

A classic case can be seen with Bitcoin in late 2017. An initial price hike was fueled further with “investors” who knew nothing about the product, which is a good sign that the increase was unjustified. This bubble burst… Hard.

If you got in at the peak of Bitcoin’s rise to fame, your investments would have halved in value in just over a month. The illustration shows a (very real) example of what happened then.

Robo advisors are meant to prevent just this. Using them, I don’t choose individual stocks or index funds I want to invest in. All I get to decide on is how much risk I’m willing to take, and the software does the rest.

They don’t care about what the flavor of the month is. Hyped up investments like Bitcoin don’t even deter them. They just sit there.. rationalizing numbers and facts. Like a bunch of savages.

In the event their ever so complex model identifies a weakness with a certain fund in your portfolio, it’ll initiate re-optimization and move your money to higher potential funds – no manual intervention necessary.

I’m not claiming this to be fool proof, and a true measure of test will only come when the next recession hits. Regardless, I’m not staying out till it comes.

2) Good Portfolio Diversification

Robo advisors provides diversification to my portfolio. Generally, I’m lacking exposure in the foreign markets with the likes of ASB & EPF weighing heavily in the Malaysian market. Ideally, I want my investments to diversify in:

- Geolocation (Malaysian, Asian, Europe, US)

- Product (Stocks, ETF’s, bonds, treasuries, commodities, currency)

- Company size (Small, mid, large)

- Industry (Technology, healthcare, financial, etc..)

To understand how robo advisors do this, its important to first understand the cornerstone of their investments, index funds.

Index Funds

Index funds are a basket of stocks that fit a certain criteria. For example:

- S&P 500 – Tracks the largest 500 companies in the US by market cap

- U.S. Small-Cap ETF – Tracks small companies with large potential for growth

- ETFMG Alternative Harvest ETF – Tracks companies engaged in the cannabis business (wait, what?)

I’d rather have my investments spread across a variety of stocks rather than putting all my eggs in one basket. The image is a bit misleading though as the examples only show tech stocks. Other big names in the S&P 500 ETF include McDonalds, Boeing, Bank of America, and Coca-Cola.

There are arguments that it’s too heavily weighted towards the technology sector, but that’s a topic for another day.

Example

Assume I have RM100 that I’m ready to invest. With this, I can either a) put it in a robo advisor and get exposure to >100 shares through index funds, gold, and bonds; or b) own 1/13 Apple stocks, if that’s even possible. It was an easy decision for me to make.

The amount of diversification I could get with such a small amount of capital not something I’d pass up on. Of course I could directly invest into a selected fund of my choice but it goes back to point 1, removing emotions.

3) Lower fees

The next closes thing to robo advisor style investing are mutual funds. They pool funds from investors (you and I) and create portfolios for their clients.

Their difference stems from the fact that mutual funds are actively managed by professionals, getting involved in individual stocks and more complex investments like warrants and IPO’s.

On the other hand, robo advisors generally stick to passive, low involvement products like index funds, commodities, and bonds.

Due to this, it’s natural that mutual funds charge higher annual fees than robo advisors. The professionals actively managing the fund on a day-to-day basis need their salaries paid while the overhead fees of robo advisors are kept low.

In 2019, a quick search shows that mutual funds have sales charges (entry fee) of ~5% and annual fees of ~2%. In contrast to this, robo advisors only charge annual fees up to 0.8%.

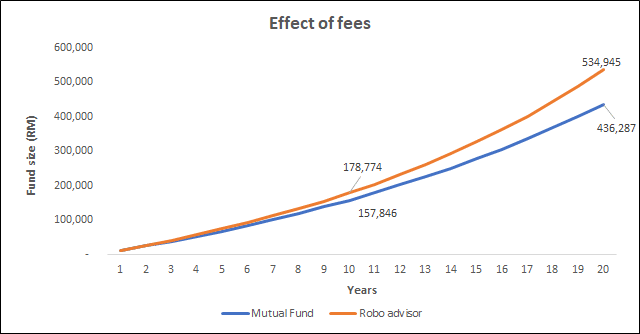

I’ve came up with a quick chart to illustrate the impact of mutual fund’s higher fees.

Assumptions made:

i) Yearly deposit of RM12k

ii) Same returns @ 8% annually

iii) Fees as above

By year 10, funds placed in the robo advisor would be ahead by RM20k. By year 20, this amount goes to a whopping RM100k… A 20 year time horizon is not unimaginable for millennials.

Having said this, I’m not telling you to completely rule out mutual funds. In fact, I’ll admit that I need to dig a bit deeper into the different funds available and do a proper comparison, which will come in the future.

There certainly are fund managers who are extremely good at their jobs and can outperform robo advisors. In this case, I’d have no issues paying the higher fees since they’re justified with better performances. Problem is, these mutual funds are few and far between.

My Start To Robo Advisors

When news came out that the first robo advisor was coming to this part of the world, I couldn’t contain my excitement. If there’s two things I love, its finance and technology. Combining them together? Imagine.

As soon as it was launched, I was in. RM100 in hand (not literally) ready to dump into this and try it out. Who would’ve thought I had to be placed on a waiting list..

My Real Start

Soon after, I finally managed to get my RM100 invested. This was in December 2018, one of the worst months in US stock market performance in recent times (unknown to me). Initially, I checked my balance multiple times a day to see if I’ve made enough money to buy my first Lambo. I then realized figures only update once a day (facepalm).

By January 2019, the US stock market had recovered. I was convinced. I immediately set up my weekly deposit amount to be auto-deducted from my bank account, no manual steps needed. As luck would have it, 2019 was the strongest performing year for the US stock market since 2013. This doesn’t matter to me though, I’ve been consistently and will consistently add funds on a weekly basis.

Having completed my first year in, I’m comfortable with the idea of letting robo advisors manage my portfolio. It’s the perfect start to get exposure to international markets, especially for those with small capital (only RM100 initial deposit for all), providing valuable diversification.

My next article will be a continuation of this, explaining my thoughts on the benefits and things I don’t like about each of the 3 robo advisors in Malaysia.

If like me you can’t wait to start investing, use the links below to get started!

StashAway – Get your funds managed for 50% off for 3 months (Up to RM30K)

WahedInvest – Use the code emibin1 when you sign up, and both you and I get RM40. That’s 40% immediate returns!

MyTheo – Get 3 months managed for free

Thanks for share this article it’s very helpful to me.

Best regards,

Dinesen Valenzuela

Ive been on StashAway since October 2019, invested RM10 in there just to see what happens over time, been casually checking into the account once in while and not gaining positive returns YET but um im excited to what happens in the long run. Great Post !

Thanks for the support! With investments like Stash Away, there always will be volatility in your returns, especially in the short term. Just keep at it and let the account grow!

I’m sold

Good man