Table of Contents

Index funds are great investments, especially for beginners or people who don’t want to spend too much time thinking about their portfolios.

While I do have my fair share of investments there, I also like hand picking good quality companies and building my own mini index fund! In our previous article, we talked about good brokers in Malaysia and how Etoro is our current choice.

In this article, I’ll talk about how I plan to build a 5 figure stock portfolio (hopefully) and why I think Etoro is the best option for us right now.

First up, let’s take a look at what my portfolio looks like!

My Current Investments With eToro

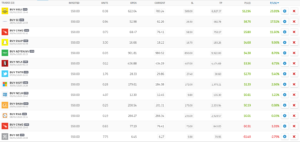

I currently have my investments spread out over 12 different companies, which is nice diversification! While some of them are high quality stocks with good potential for growth, I’ll admit that I bought General Electric (GE) & Norwegian Cruise Line (NCLH) in hopes that they’ll bounce back after being dumped.. hard.

These companies aren’t performing the best right now as they operate in heavily affected industries – airlines & cruises. Investments in them may flop, but a quick recovery to normalcy can bring nice returns. I’m not holding my breath though, which is why I didn’t put too much into them.

Currently, I’ve invested $650 in these stocks with an unrealized gain of $43. I also have $391 leftover that I plan to utilize in the next correction, bringing my Etoro portfolio amount to $1,084.

![]()

When converted into MYR, this comes up to roughly RM4.7k. Not too bad, but still less than half way in achieving my goal of building a 5 figure portfolio!

How I Plan To Build This Up With Etoro

1. Consistently adding capital

This is the surefire way to build a larger portfolio, just keep adding money in! For starters, I plan to add around $50 every month, or RM215. Over time, I want to increase this amount to $100 (RM430) or even more if I can. Need to stretch my budget a bit more!

This is one of the reasons I like eToro over other international stock broking platforms like Interactive Brokers & WeBull. These guys have their bank accounts set up in the States, meaning I need to perform foreign telegraphic transfers every time I want to make a deposit.

For those of you that don’t know, FTT’s can be very costly especially when our deposits are small. I previously wired RM4.2k into Interactive Brokers and my local bank (CIMB) charged me RM10 for the transfer. Not too shabby, right? Well, I didn’t know that the receiving bank (Citi) also charges me $25 USD for receiving the money… What???

This brings my total cost of depositing to RM120. How am I supposed to add RM200 every month with these fees? I’d have to save up to a larger amount before it makes sense for me.

Fortunately, eToro has bank accounts set up in Malaysia, meaning I can make direct local bank transfers to deposit my money. This means, no fees. Of course, your MYR will somehow need to be converted into USD but eToro seems to be doing this at spot rate aka Google rates so it’s fair.

If I manage to deposit RM430 a month every month, it’ll increase my portfolio by a nice RM5,160 every year. Great!

2. Generating good returns through high conviction stocks

For obvious reasons, I can’t just be adding capital to achieve my RM10k portfolio goal. If that were the case, I may as well channel my deposits into another savings account with similar results.

What we want is for our money to get married and have kids so we’d have some baby money. And to make sure this goes well, I’d want my money to have excellent genes in producing high quality babies!

That might’ve been a bit confusing..

Essentially, I’m looking for the best quality stocks that will be future leaders in growing industries to hold in my portfolio. At this moment, my picks are companies in e-commerce (Shopify, Mercado Libre, Sea Limited), digital payments (Adyen, Square, Paypal), and cloud based companies with Software as a Service models (Adobe, Crowdstrike, Microsoft).

These companies are in industries that will shape our future, where the recent pandemic has just sped up this transition. I believe in e-commerce – I use it for a lot of my purchases and I know a lot of others do as (though they might not like to admit their impulse purchases).

Digital payments – who doesn’t use Boost, Grab, or TNG these days? It may not be the same companies, but it’s the same industry!

That sums up my two step strategy in achieving my RM10k portfolio goal. Step one will make up the vast majority of building this, and it’s something that we always preach being – constantly add to your investments, regardless of market condition.

Step 2 will help aid some of this, and it really depends how well my investments perform. However, we should all know by now that short term fluctuations shouldn’t deter us as we’re building for the long run!

Now, onto why I chose eToro other than the benefits mentioned above.

Why eToro is my broker of choice

1. Low minimum trade & fractional shares

This is probably the #1 thing I’m looking for in my brokers at the moment. Because my starting capital is so small, I’m usually not able to diversify my portfolio enough when buying stocks.

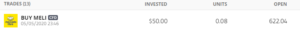

Thank God for fractional shares then. It’s a feature that not many brokers provide, essentially allowing investors to own a portion of shares instead of round numbers. To illustrate this, I’ll show my example ownership of South American e-commerce company Mercado Libre (MELI).

You can see that I opened my position when 1 stock was worth $622.04. Using other brokers, this would eat up ~60% of my entire $1,000 deposit, leaving me with not much left to buy other shares.

However, eToro allows me to buy fractional shares with a minimum trade of only $50! So, I decided to buy $50 worth of MELI shares leaving me with 0.08 units 🙂 This is super important for investors with smaller capital amounts like myself. As you start building towards the $50-100k mark, I guess it’ll matter a bit less.

For now, this is probably the main feature I look for when choosing my broker. It’s the sole reason I was able to buy 12 different stocks for my portfolio with just $1,000.

2. Ease of deposits and deposit fee

Mentioned this above but I’ll just leave this here. eToro accepts local online bank transfers which many other foreign brokers don’t. This ensures I don’t pay too much in fees when depositing monthly.

3. eToro CopyTrade functionality

CopyTrade is a neat little function that allows investors to copy positions opened and managed by others.

For example, let’s say John likes me as an investor and decides to copy my trades with $200. I then decide to buy $50 worth of MELI which is 5% of my portfolio. Automatically, eToro will open a MELI position for John for 5% of his $200. When I decide to sell, he will close his position too.

Basically, I become a fund manager that John decides to invest with. He trusts me with his money and hopes I grow his money for him.

Now I want to make it clear that I don’t advise any of you to copy my trades. I don’t have the confidence that I will be able to perform well or beat the market at this moment and I’m still too new to this.

Personally, I’m not entirely sold on this function myself. Maybe it’s my ego thinking why I would need to copy someone else when I have trust in my own investment philosophy. It also takes away the fun 🙁

Having said this, I might throw in $200 (the minimum CopyTrade amount for most) into a Popular Investor that has good investment philosophies and returns just to give it a go. After all, there are many investors who are more into the commodity, cryptocurrency, and FOREX portion that I have no exposure or experience in.

Let’s see. It’s a cool concept that may be useful to some but it’s definitely a side benefit of this platform to me.

Main Thing I Don’t Like About eToro

I don’t want to conclude this article without mentioning something I don’t like about the platform. Investments in eToro are Contract for Differences (CFD’s) meaning you don’t own the actual asset.

I don’t actually own 0.08 shares of MELI, I own a contract that will pay me the difference between my buy and sell prices.

Personally, I’d want to eventually own these assets myself. I know eToro Europe has the functionality to do this and I’ve heard from a source that they’re bringing this to Asia! I’m eagerly waiting for this but I don’t really mind it for now.

This sums up the article! It’s a goal I’m striving to achieve by February 2021, so stay tuned for the portfolio updates! I’m excited to be on this journey and if it spurs just one person to start their investment journey, I’d be super happy 🙂

If you want to try out eToro, you can use my link here. We’ll both get a $50 reward once you deposit $200 in! You can also open up a demo account to try it out first if you’re not comfortable putting real money in it!

Other reads you may be interested in:

Now SC Malaysia has warned investors that Etoro is not a licensed… will it be a problem for us who already invest woth Etoro?

Very legitimate question! We’ve spoken to eToro and they brought up some very good points. Firstly, many other reputable brokers such as Interactive Brokers & WeBull are also not regulated by SC Malaysia. They don’t see a purpose of it. Instead, these brokers are regulated by their respective countries SC equivalent.

In eToro’s scenario, they’re regulated by ASIC which is Australia’s Securities & Investments Commission. The Malaysian SC was right in saying we wouldn’t get protection from them. However, ASIC will bear responsibility of our eToro portfolios as they are holding our deposits/investments.

TLDR; at this moment, we don’t see an issue with SC Malaysia’s statement!