Table of Contents

A few weeks ago, we asked you guys on Instagram what your favourite credit cards were in Malaysia and got a bunch of responses.

To be honest, it’s been a while since we reviewed the credit cards we owned and most of them don’t give out the best benefits anymore yet we still keep using them.

So we’ve compiled your responses and did some additional research and we’re ready to share some of the best credit cards Malaysians can sign up for in 2023!

In choosing this list, we consider the minimum income requirements, cashback amounts, and any restrictions on spending like amount, day of the week, and spending categories.

We’re also much bigger fans of cashback credit cards compared to points or rewards cards so all of them on the list today will be focused on cashback.

Not sure why you need a credit card? Check out our video on 3 reasons why you must have one.

Anyway, let’s get right to the list!

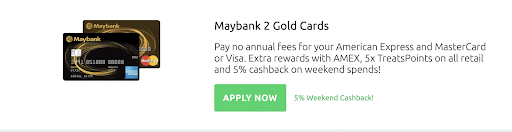

Maybank 2 Gold Card

Minimum income RM2,500 per month

This pair of cashback credit cards can be considered an OG on the list, and I think it still remains as one of the top options out there if you use your credit card in certain ways.

For the higher earners, there’s the Maybank 2 Platinum Card but the differences are pretty small.

I’ve hit the income threshold but still haven’t made the switch because I don’t think it’s worth the effort.

Anyway, I got this credit card pretty early in my career and it has been nearly 4 years of great cashback.

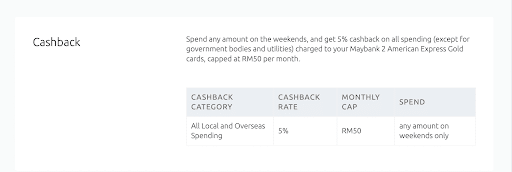

The thing is, you’ll only get the juicy 5% cashback if you spend on weekends with merchants that accept AMEX.

There’s also a cap of RM50/month in terms of cashback, so spending up to RM1,000 will be sufficient to get the max reward. If I go past this amount in a particular month, I just stop using it because you don’t get much else.

The cashback category is pretty broad, working on nearly all spend except payments to government bodies and utilities which is a shame.

We used to be able to pay off our PTPTN loans and electricity bills on the weekends with this card to get the sweet cashback but they stopped it a while back.

Instead, we currently use the card on the weekends for things like petrol, groceries, dinners, phone bills, and shopping with most of these merchants accepting AMEX as a payment method.

Apps like Shopee, Lazada, and Grab all accept it so we usually hold off on buying stuff till the weekend to get the cashback.

If you use the AMEX card on the weekdays, you get Maybank Treats Points instead which I don’t think is so worth it compared to the other options you have later down this list. You also get a choice for your second card between Mastercard and Visa which gives you the same TreatPoints instead of cashback.

We chucked that card into the drawer and have never used it before. Not so worth it.

Apply for a Maybank 2 Gold Card now.

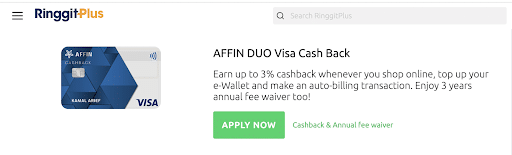

Affin Duo Visa Cash Back

Minimum income RM2,000 per month

We didn’t even know about this cashback credit card until you guys shared it with us – and it looks pretty great!

While it doesn’t give the same 5% as the Maybank AMEX and may not cover all purchases, there isn’t a restriction on when you can spend. It’s also a Visa card which means way more merchants should accept it compared to an AMEX.

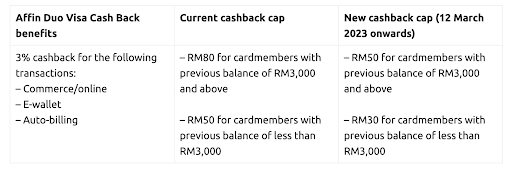

In terms of spending category, you get 3% cashback on any online spending, e-wallet reloads, or auto-billing.

We don’t have very many payments set on auto-bills, but when we get this card we’ll probably get some of the utility bills like electricity and water on it since the AMEX doesn’t give cashback there.

What interests me more though is the cashback on any online spending and e-wallet reloads.

I use e-wallets like Grab and TNG a lot so getting an extra 3% on my top ups will get me a nice amount of cashback. And while we try to get most online spending done on the weekend, it’s not always possible so having this will come in handy as well.

We also really like the fact that there isn’t a minimum spend to be applicable for the cashback which many other cards do. You will get a higher monthly cap on online spending and auto-billing if you spend above RM3,000 per month but it doesn’t really matter if you don’t.

Spending RM1,700 will be enough to get you the max cap of RM50 per month for each category but even if you don’t you’ll still get the 3% back.

However, they just announced that they will revise the cap down to RM30 starting in March but they’re keeping the same 3% with no min spend which will bring the max spending down to RM1,000 per category.

Apply for the Affin Duo Visa Cashback Card now.

UOB One Visa Platinum

Minimum income RM4,000 per month

Note: There’s a lower tier alternative with slightly less cashback with minimum income of RM2,000 per month. UOB One Visa Classic

This to me looks like the best everyday cashback credit card option at the moment with up to 10% cashback on petrol, dining, grocery, and Grab.

I guess it’ll differ from person to person based on what your spending habits are like, but dining and groceries are what I use my credit card the most for.

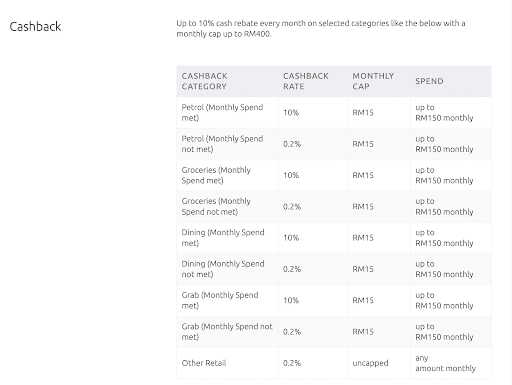

Their cashback structure though is a bit more complex, with different rates depending on whether you hit the minimum spend.

Unlike the previous 2 cards on this list, not hitting the minimum spend on this card will only give you a cashback of 0.2% which being honest will probably amount to peanuts. At this rate of inflation, we’re not even sure if you’d be able to afford the peanuts!

However, I can kinda accept it because the min spend for this card isn’t too high at RM1,200 a month. If you opt for the UOB One Visa Classic instead, the minimum spend goes down to an even more reasonable RM500.

This isn’t a small amount by any means, but it’s a number I’d probably be able to hit every month if I used this as my everyday card.

Similar to when we were talking about the Affin Duo card, this will be the perfect alternative to the Maybank AMEX when you swipe your card on weekdays.

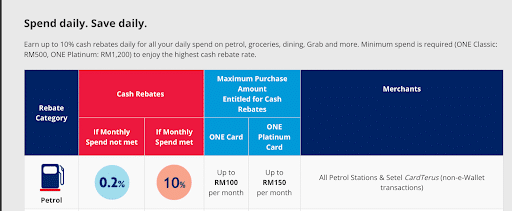

At a 10% cashback rate with a cap of RM15 (or RM10 if you opt for the classic), it shouldn’t be too hard to hit your caps.

Spending RM150 (or RM100 for classic) a month on petrol, groceries, dining, and Grab each will already get you the max cashback of RM60 (or RM40 for classic) per month.

Obviously we probably wouldn’t hit the max for every category each month but if we do, that’s already RM600 spent. You then have to spend another RM600 on anything else to be eligible for the cashback.

Since the cashback rate is at 10% vs the 5% on AMEX, we’ll probably prioritise this one first every month before switching over when the caps are hit.

Think carefully about which card between the Platinum and the Classic you go for because hitting the minimum spend monthly will be critical for the usefulness of this card.

If you aren’t sure if you’ll spend that much, it’s probably the safer option to go for the Classic first and switch once you’re certain of your spending habits.

As this will replace my current HSBC Amanah as my everyday credit card, I’ll be going for the Platinum option as I’ll most likely hit that RM1,200 monthly.

Apply for the UOB One Visa Platinum or UOB One Visa Classic.

Choosing the right credit card for you

With plenty of options out there offering rewards that are unique in its own way, which cashback credit card you go for will boil down to your spending patterns.

The 3 credit cards I shared above are the ones that suit me best. Based on the responses to our Instagram story, it seems like most of you tend to agree!

When applying for a credit card, check out offers on RinggitPlus as from time to time there’ll be great offers like vouchers, airpods, and even chances to win things like iPhones.

All links shown in this post are affiliate links, so do click on them to support this blog!

Found this article useful? Share it with your friends & family! We’d really appreciate the love & support 🙂

Check out our related articles and videos:

How To Start Investing For Complete Beginners – Part 1

3 Reasons You Need a Credit Card

Investing while you spend on your credit cards with Raiz Invest