Table of Contents

I tried out Raiz Invest Malaysia… here’s my honest opinion on it.

How Raiz Invest Malaysia Works

The entire concept behind Raiz Invest is centered around micro-investing, allowing its users to invest small amounts of money which in most cases will be less than RM1.

What they do is they connect the app to your bank account, and round up everyday purchases into a whole dollar to invest the rest.

Let’s say you buy something that costs RM5.50 with your card — Raiz Invest will then round this up to the next whole dollar being RM6, and invest the extra RM0.5 on your behalf!

Now THIS is a cool new concept.

There are so many Financial Technology companies (FinTechs) out there that seem to be targeting the same audience.

Unlike any of them, Raiz invest has actually carved out a very nice niche in the space to attract users and it’s definitely something worth exploring.

To test out how this would work, I linked my Maybank Debit Card into the app and started making some purchases.

The app rounded up my spending and invested tiny amounts of money into my Raiz Investing account.

I think this is an extremely clever way for beginner investors to start investing slowly without feeling the immediate burden of forking out a large sum of cash into an investment.

It’s also automatic, meaning you don’t really have to put much thought into manually depositing money or even setting up scheduled transactions

Raiz Invest’s Biggest Flaw

As of the making of this video, they ONLY support Maybank Debit cards for the micro-investing feature.

Basically, if you don’t have one, it won’t work.

For those of you who know me, I only ever use my credit cards for purchases and my debit card is reserved to withdraw money from an ATM.

This means that the micro-investing feature is pretty useless to me now.

It only showed transactions because I actually went out of my way to use the debit card just to test out the app for this video! Good thing I had a Maybank one lying around.

Since I genuinely love the feature but won’t forego using credit cards for it, I actually sent an email to the Raiz support team for clarity.

Raiz Invest Malaysia Exclusivity

For some reason, they have an exclusive contract with Maybank Debit Cards for the first few months of their operation here in Malaysia.

Why would Maybank limit a deal to only their debit cards and not credit cards? Maybe its more of a security issue?

Unfortunately due to this, I won’t be using the Raiz micro-investing feature until they open up credit cards to the app.

I expect the support of credit cards from banks outside of Maybank to be delayed even further, as they seem to have some exclusivity thing with Maybank.

This isn’t as big as a deal compared to not supporting credit cards completely, but it’s definitely something the team needs to improve on.

It’s a shame but at least something to look forward to in the coming months!

Raiz Invest Malaysia’s Investment Portfolio

So we’ve gone through how we fund our Raiz Investing account, but where does this money actually go?

To give a bit of background, Raiz Invest is actually an Australian FinTech company that also operates in both Malaysia & our neighbours Indonesia.

It’s actually listed on the Australian Stock Exchange and is currently worth about $50m.

They just came into the Malaysian market in 2020, as a joint venture between their Australian parent company and Jewel Digital Ventures, which is wholly owned by PNB.

PNB is the fund manager of all Amanah Saham funds in Malaysia.

So far we know 2 things:

- Raiz Invest Malaysia is under Jewel ventures which is wholly owned by PNB.

- Raiz Invest Malaysia seems to have launched the product with some exclusivity agreements.

Well, no surprises then that all investment products in this app are only limited to PNB funds.

The 3 funds involved are all variable rate funds, meaning the prices fluctuate on a day to day basis.

The 3 funds that Raiz Invest Malaysia invests in are:

- ASN Equity fund

- ASN Sara fund

- ASN Imbang Fund

What you invest in depends on the risk level you allocate for yourself with a choice of conservative, moderate, or aggressive.

So far, my portfolio is down about 3.67% which to be honest isn’t really that big of a deal to me.

Remember, we’re investing for the long term so one month worth of results shouldn’t deter us.

The more important thing is, how have these 3 funds performed in the long term?

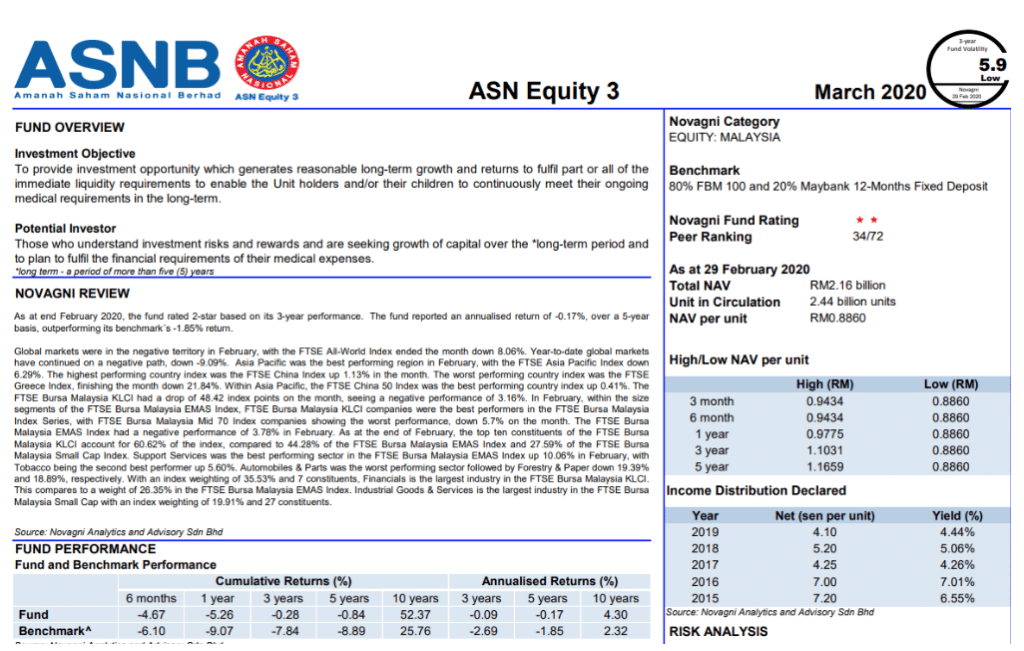

ASN Equity Fund

The ASN Equity fund is meant for long term growth with a high weightage towards equities, with 80% of it tracking the Malaysian stock market and the remainder in Maybank Fixed Deposits.

They hold some pretty nice names and I recommend going for this one if you’re looking long term.

Over the past 5 years, the fund has been performing OK but income distributions have declined since 2015, as per all other PNB funds.

As I mentioned, all 3 of these funds are variable priced funds and the NAV per unit has actually declined year over year over the past 5 years, so that’s something to look out for.

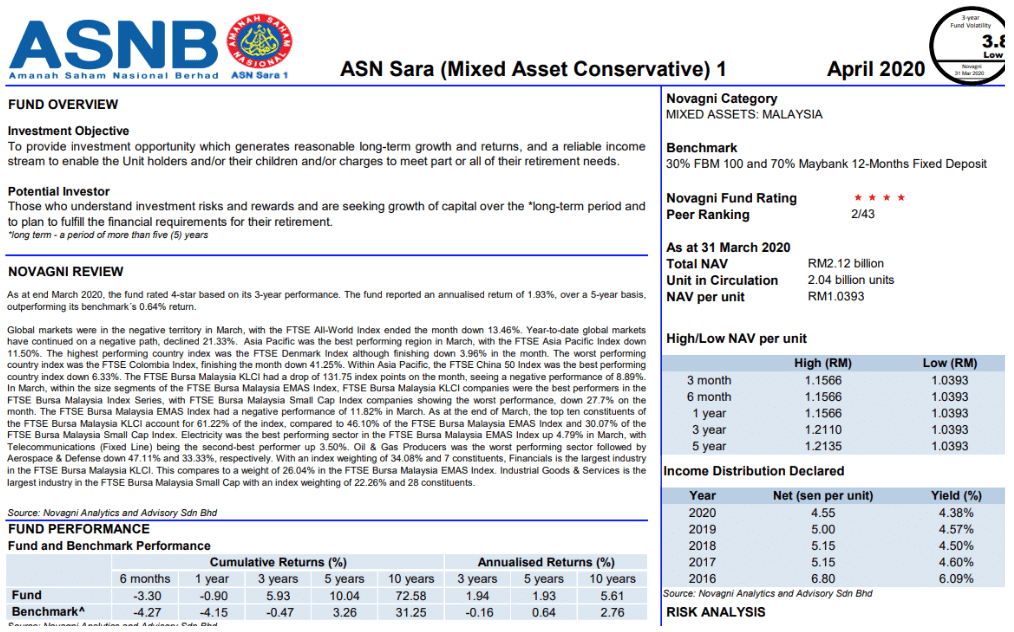

ASN Sara Fund

On the other hand, the ASN Sara fund is meant for retirement so it naturally is a move conservative fund with only 30% in Malaysian equities and 70% in fixed deposits.

Performance wise, it’s very similar to the Equity Fund in terms of income distribution surprisingly.

However, the NAV per unit has declined by less than its peer, meaning its actually better off over the last 5 years.

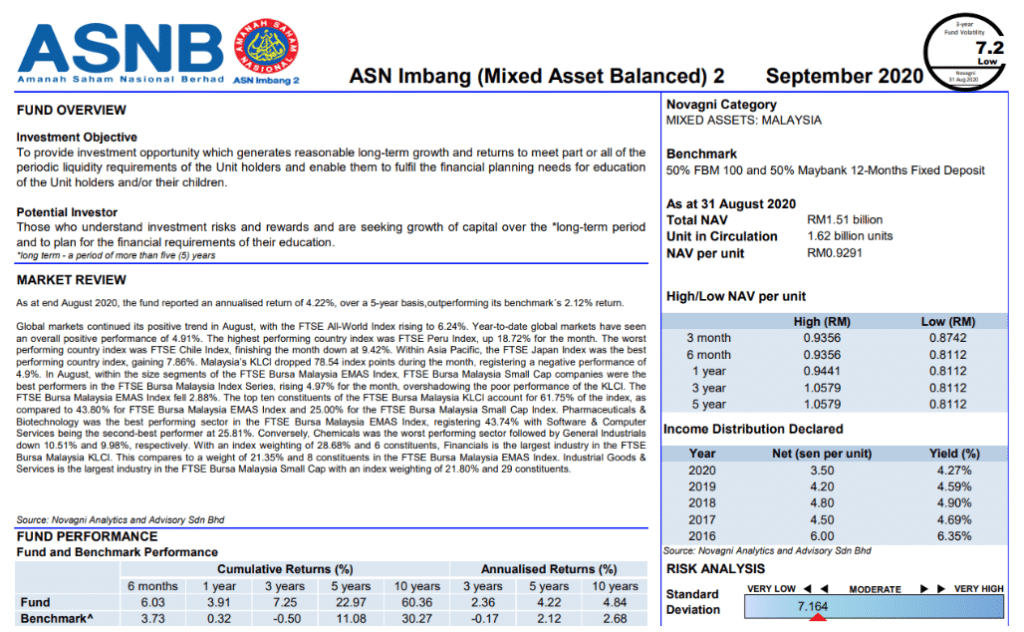

ASN Imbang Fund

Finally, the ASN Imbang Fund sits somewhere in between the Equity & Sara funds, with 50% each in equities and fixed deposits.

Raiz Invest Malaysia Performance

Performance wise, all 3 of these funds seemed to have performed close to parallel in the last 5 years, so I guess there isn’t much to choose from.

You know what I would love from Raiz Invest?

It’s a long shot due to their links with PNB but if they’d just allow us to choose options other than PNB funds, that’d be great.

I did some digging into the Raiz Australia app and they have a wide variety of funds globally like the Australian, Asian, Europe, and American large cap funds.

Raiz Invest Malaysia & PNB.. please let this happen for us too.

I know they have their own interests in mind when limiting it to PNB funds but opening it up could really attract a lot more users.

Raiz Invest Malaysia Fees

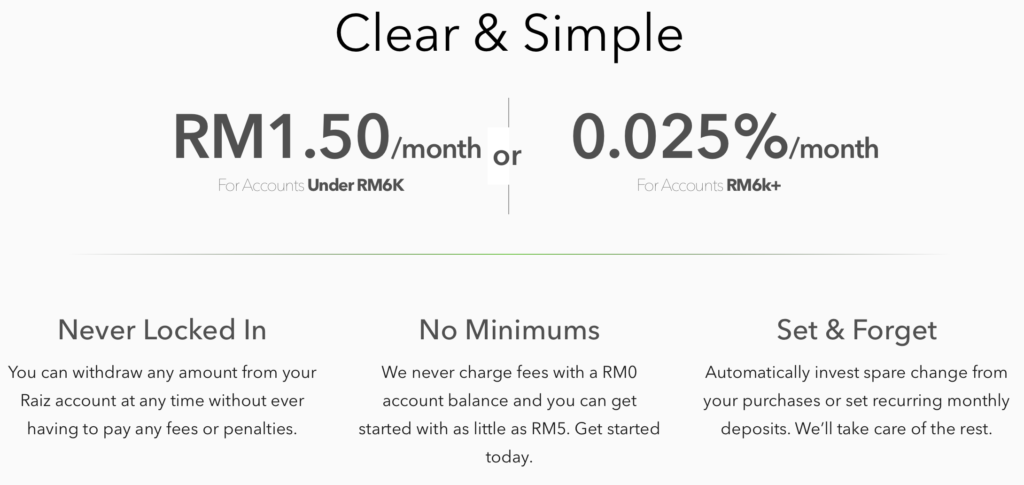

Fees wise, Raiz charges RM1.50 a month if your account is below RM6,000 or 0.025% if it’s above that mark.

Honestly, it’s a bit steep unless you have a large amount of money in the account.

At RM150 worth of investments, its a 1% charge monthly or 12% annually. That’s insane.

A more realistic fee structure should be around the 1-1.2% mark max annually, meaning you’d need to have RM1,500 worth of investments for it to be worth it.

However, due to the current limitations I just cannot see myself putting RM1.5k in.

How Raiz Invest Malaysia Can Improve

I really love the concept of this app and I’m sure they’ll improve and expand on it as we progress.

I actually haven’t been this excited about a fintech app since StashAway launched in Malaysia.

However, 3 things need to be fixed…

First, Raiz Invest Malaysia needs to support credit cards for their round-up offerings and expand it beyond Maybank eventually.

Second, they need to open up their funds to things beyond what is offered by PNB. I’m much more willing to put more money in the app if this was the case.

Finally, the fee structure is a bit too high for small amounts of investments.

The final point is a bit linked to the first and second points. By limiting the functionalities to Maybank Debit cards, I won’t be contributing through the round-up feature.

Also, having only PNB funds means there’s no point for me to put in RM1.5k of my own money as a manual deposit. Why wouldn’t I just do this through ASB directly right?

If Raiz Invest Malaysia fixed both number 1 & 2, then the fees wouldn’t be a problem at all to me.

Anyway, I’m super excited to follow up with updates from the Raiz team and I hope they start executing things well!

Until then, I’ll be staying out of Raiz Invest Malaysia and I don’t recommend the app to most people unless you use a Maybank debit card a lot.

If you’re interested however, you can use our link by clicking here to get RM5 when you sign up.

For more info about Raiz Invest Malaysia, you can visit their website here.

What to read next? Try these out: